What is an Accounting Clerk Cover Letter

An accounting clerk cover letter is a document that accompanies your resume when applying for accounting clerk positions. It serves as an introduction to your qualifications, experience, and skills, allowing you to showcase your suitability for the role. Unlike a resume, which provides a factual overview, a cover letter lets you express your personality, enthusiasm, and specific reasons for wanting the job. It’s your chance to highlight why you’re the best candidate and to make a positive first impression on the hiring manager. A well-crafted cover letter demonstrates your communication skills and attention to detail, which are crucial in the accounting field. It should be tailored to each specific job application, emphasizing the skills and experiences that align with the employer’s requirements. The goal is to secure an interview by providing a compelling narrative of your career aspirations and how you can contribute to the company’s success.

Why is a Cover Letter Important for Accounting Clerks

A cover letter is incredibly important for accounting clerks because it provides an opportunity to go beyond the basic information presented in a resume. It allows you to explain your career goals, elaborate on your skills, and demonstrate how your qualifications align with the specific job requirements. In the competitive job market, a cover letter can set you apart from other applicants by showcasing your personality and enthusiasm. For accounting clerks, a cover letter is a chance to highlight key skills such as attention to detail, accuracy, and organizational abilities. It shows you understand the job’s requirements and are eager to fulfill them. Furthermore, it gives you the chance to address any gaps in your employment history or explain why you’re changing careers. Hiring managers value candidates who take the time to personalize their applications, and a well-written cover letter proves you are serious about the position and have taken the effort to understand the company and its needs.

Key Sections of an Accounting Clerk Cover Letter

Your Contact Information

Start your cover letter with your contact information. This includes your full name, phone number, email address, and sometimes your LinkedIn profile URL. Place this information at the top left of the letter. Make sure your email address is professional-sounding. Ensure your phone number is current and that your voicemail is set up professionally, in case a potential employer needs to contact you. This information is crucial so the hiring manager can easily reach you to schedule an interview. Always double-check your contact details to avoid any typos or errors.

Hiring Manager’s Contact Information

If possible, address your cover letter to a specific person—the hiring manager or the recruiter. Research the company and find out who is in charge of hiring for the accounting clerk position. Include their name, title, the company’s name, and their address. Addressing the cover letter to a specific person shows that you’ve taken the time to research the company, which demonstrates your genuine interest in the position. If you can’t find a specific name, use a professional greeting like “Dear Hiring Manager”.

The Salutation

Use a professional and appropriate salutation. If you know the hiring manager’s name, use “Dear Mr./Ms./Mx. [Last Name]”. Otherwise, use “Dear Hiring Manager”. Avoid casual greetings like “Hi” or “Hello” as these are less formal. Ensure the salutation is consistent with your overall professional tone.

Opening Paragraph Grab Their Attention

Your opening paragraph should immediately grab the hiring manager’s attention. Start by stating the position you’re applying for and where you found the job posting. Briefly mention your most relevant qualification or a key skill that matches the job requirements. Show your enthusiasm for the role and the company. Use this paragraph to make a strong first impression and set the tone for the rest of your cover letter. Keep it concise and impactful, making the reader want to continue reading.

Highlight Your Skills and Experience

Accounting Software Proficiency

Highlight your experience with accounting software such as QuickBooks, SAP, Oracle, or Xero. Mention any specific software you’re proficient in and how you’ve used it in previous roles. Be specific about tasks you’ve performed, such as data entry, report generation, or reconciliation. If you’ve completed any software certifications or training, include these as well. This section is crucial because proficiency in accounting software is often a key requirement for accounting clerk positions. Provide examples of how you’ve used these tools to improve efficiency or accuracy in your previous roles.

Accounts Payable and Receivable

Describe your experience in accounts payable (AP) and accounts receivable (AR). Mention specific tasks you’ve performed, such as processing invoices, managing payments, preparing financial reports, and following up on outstanding invoices. If you have experience with vendor management or customer relations, mention it here. Highlight your ability to manage these processes accurately and efficiently. Use specific examples to show how you’ve improved AP/AR processes in previous roles. For example, mention how you reduced processing times or resolved discrepancies.

Data Entry and Accuracy

Emphasize your strong data entry skills and attention to detail. Accounting clerks must handle large volumes of data, so accuracy is critical. Describe any experience you have in data entry, including the type of data you’ve worked with. Mention any quality control measures you’ve implemented to ensure data accuracy. Highlight your ability to identify and correct errors efficiently. If you’ve been commended for your accuracy in previous roles, include that information. Data entry accuracy is a fundamental skill that will set you apart.

Attention to Detail and Organization

Showcase your attention to detail and organizational skills. Accounting tasks require a high level of accuracy and the ability to manage multiple tasks simultaneously. Provide examples of how you’ve demonstrated these skills in previous roles. For instance, describe how you’ve managed deadlines, organized financial documents, or maintained accurate records. Mention any systems or processes you’ve used to stay organized. The ability to handle a variety of tasks, stay organized, and maintain accuracy are essential qualities for an accounting clerk.

Quantify Achievements with Numbers

Use numbers to quantify your achievements and demonstrate your impact in previous roles. For example, mention how you reduced processing time by a certain percentage, improved accuracy rates, or streamlined a specific process. Quantifiable achievements provide concrete evidence of your skills and value. Use metrics to show the results of your actions. This makes your cover letter more compelling and shows hiring managers the value you can bring to their team. Include relevant data such as number of invoices processed, dollar amounts managed, or efficiency gains achieved.

Showcase Your Education and Certifications

Include details about your education and any relevant certifications. List the name of your degree, the institution attended, and the graduation date. If you have any certifications, such as a Certified Bookkeeper (CB) or other accounting-related credentials, be sure to include them. These certifications can demonstrate your expertise and commitment to the field. If you have any additional training or coursework related to accounting, mention it here as well. Highlight any educational achievements relevant to the accounting clerk role.

Proofreading and Editing

Carefully proofread and edit your cover letter to eliminate any errors in grammar, spelling, or punctuation. Errors can create a negative impression and undermine your credibility. Read your letter aloud to catch any awkward phrasing. Have a friend or family member review it as well. Ensure the letter is clear, concise, and professional. The quality of your writing reflects your attention to detail, a key trait employers look for in an accounting clerk.

The Closing Paragraph

Expressing Your Interest and Availability

Reiterate your interest in the position and the company. Mention why you are excited about the opportunity and what you can bring to the role. Summarize your key qualifications and re-emphasize your enthusiasm. This paragraph should reinforce your desire to be considered for the position and the value you can bring. Make sure your closing statement is enthusiastic and leaves the reader with a positive impression of your candidacy.

Call to Action Request an Interview

End your cover letter with a clear call to action. Express your availability for an interview and state how you can be reached. Provide your phone number and email address again for easy reference. Make sure to thank the hiring manager for their time and consideration. A strong call to action encourages the hiring manager to move forward with your application. Ensure you have a professional closing, such as “Sincerely” or “Best regards” followed by your name.

Formatting and Layout Tips

Use a Professional Font

Choose a professional and easy-to-read font, such as Times New Roman, Arial, or Calibri. Use a font size of 11 or 12 points. Ensure your font is consistent throughout the document. Avoid using decorative or unusual fonts, as these can make your cover letter difficult to read and may not be viewed professionally. The goal is to make your cover letter easy to read and visually appealing.

Keep It Concise and Easy to Read

Keep your cover letter concise, typically one page in length. Use clear and concise language. Break up long paragraphs into shorter, more manageable sections. Use bullet points when listing skills or achievements. Ensure there is ample white space to make the letter easy to read and visually appealing. The goal is to communicate your key qualifications efficiently and effectively. Avoid unnecessary jargon or overly complex sentences.

Proofread Carefully

Thoroughly proofread your cover letter to eliminate any errors in grammar, spelling, or punctuation. Mistakes can create a negative impression and suggest a lack of attention to detail. Read the letter aloud to catch any awkward phrasing. Have a friend or family member review it. Ensure your contact information is accurate. Proofreading is a crucial step to ensuring your cover letter is polished and professional.

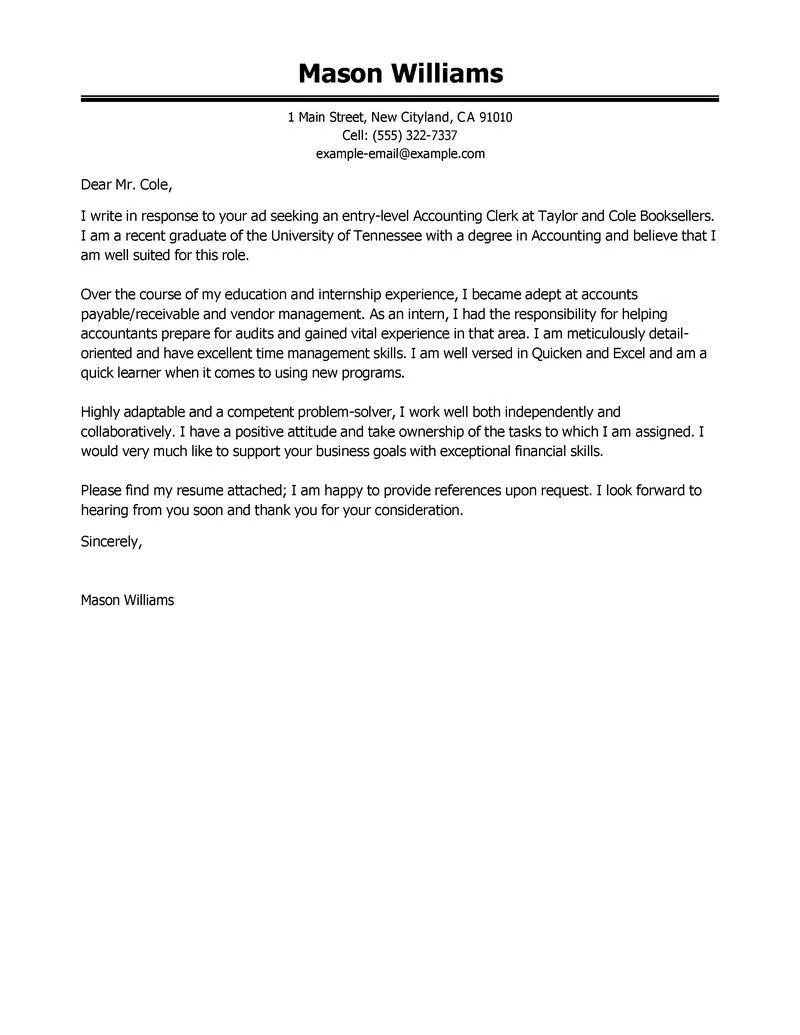

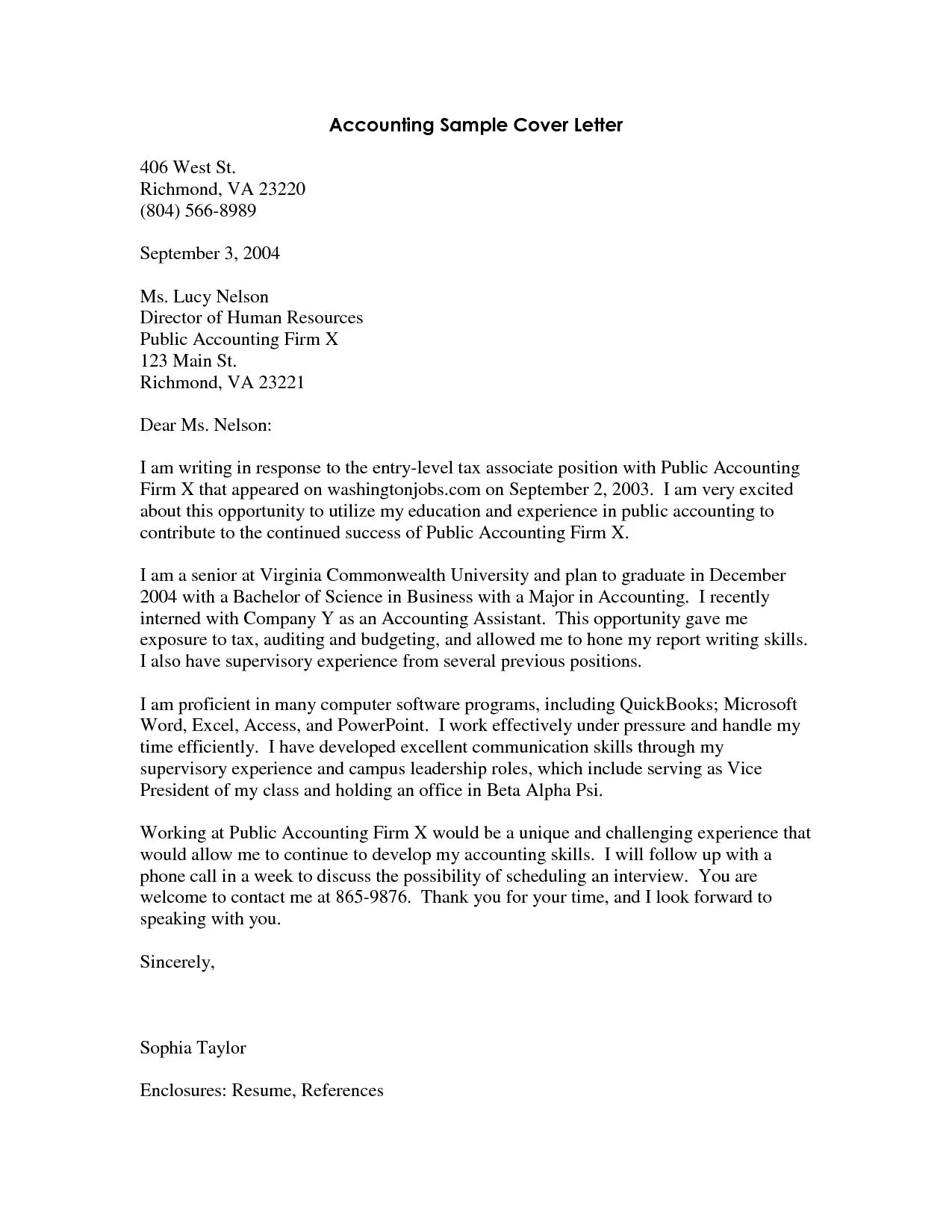

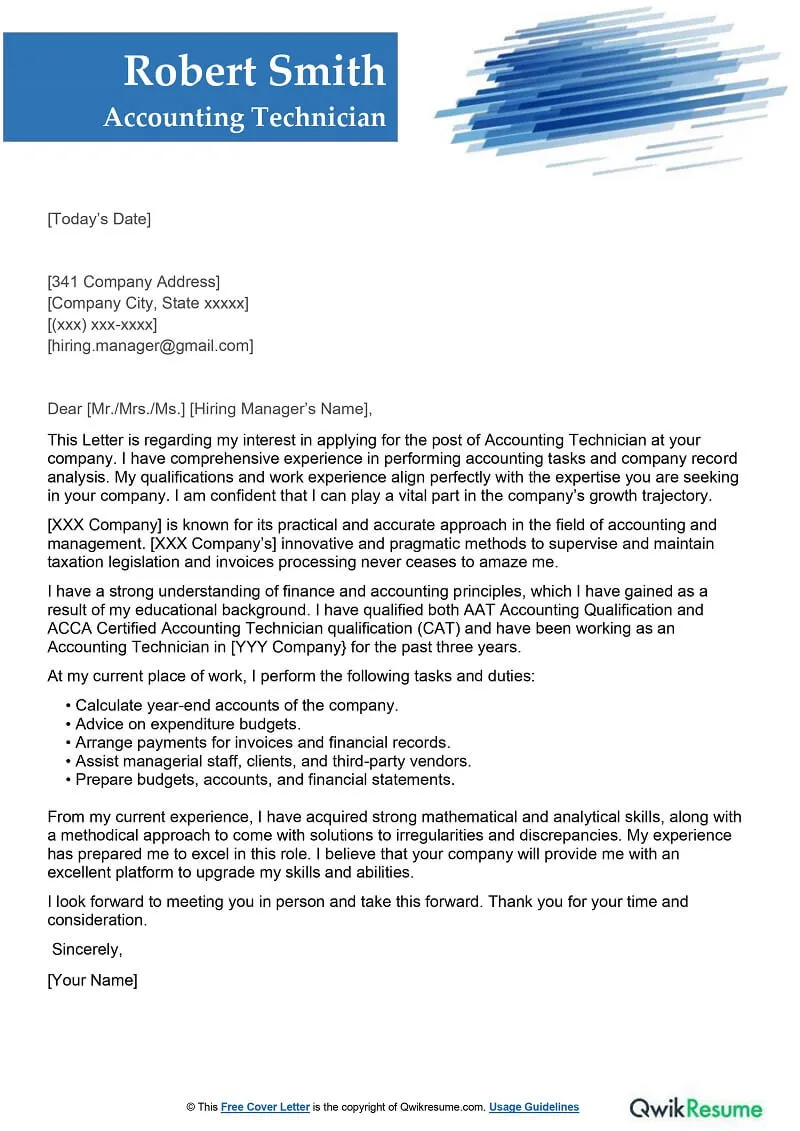

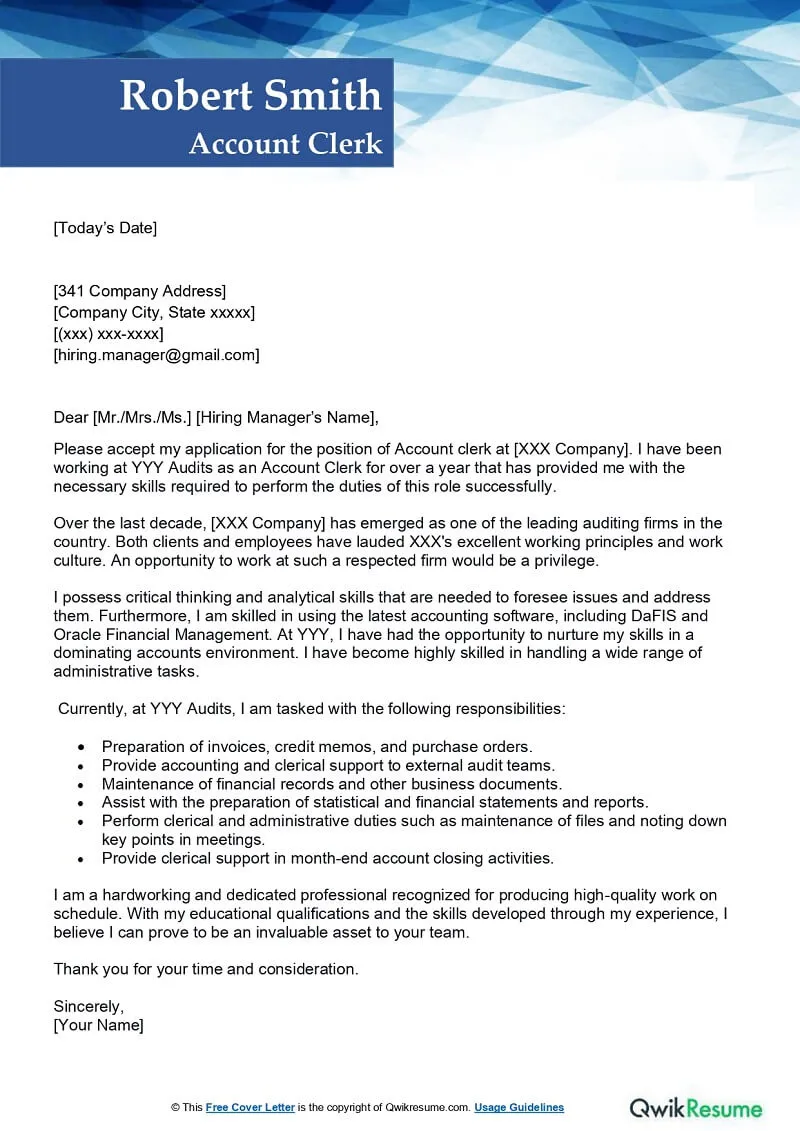

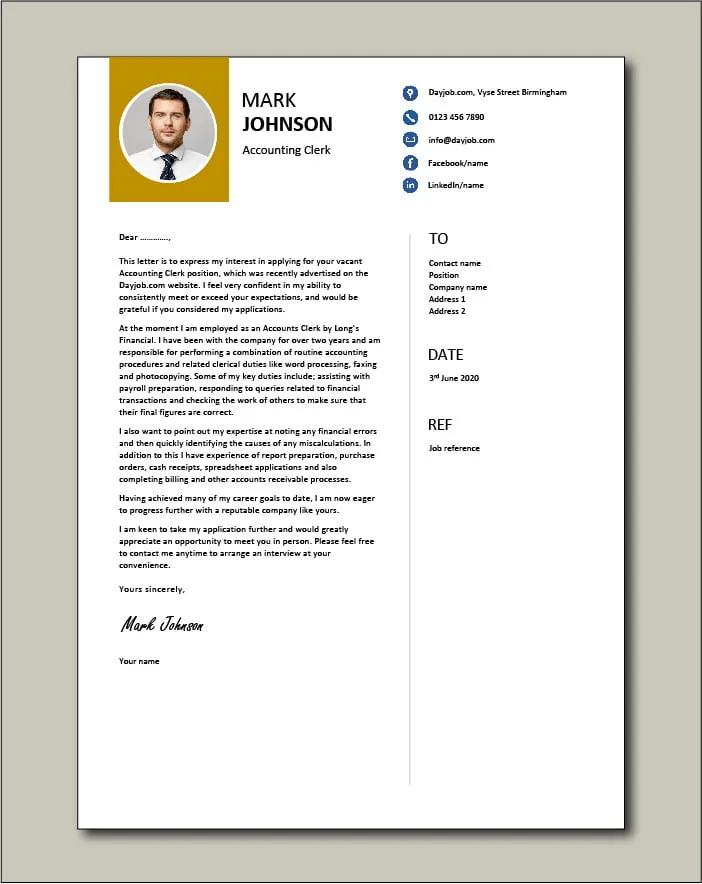

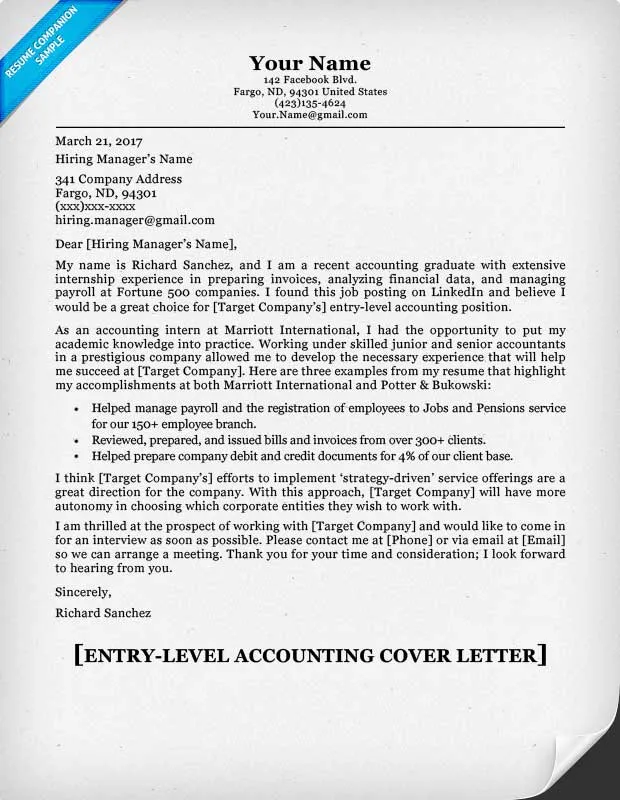

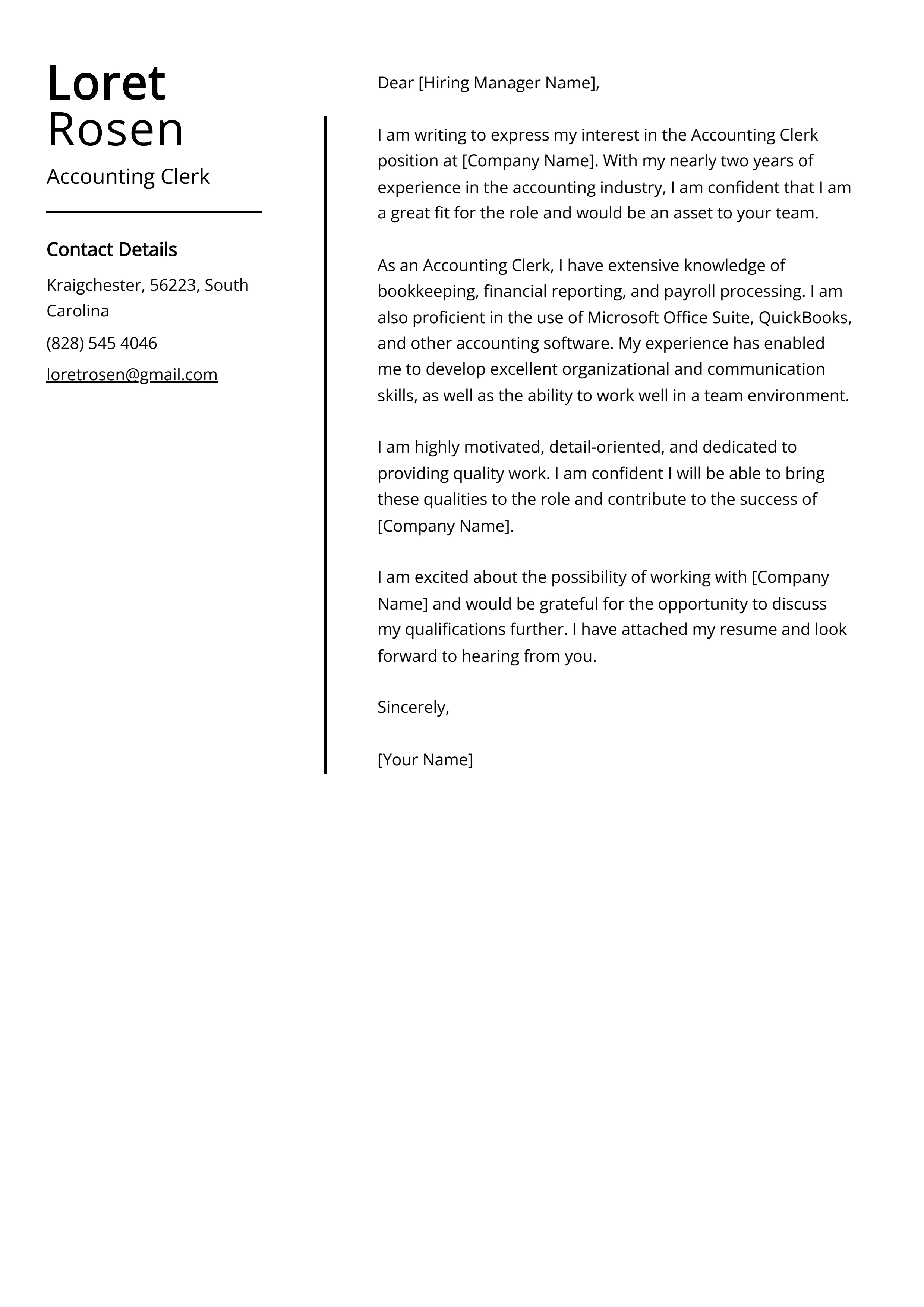

Cover Letter Examples for Accounting Clerks

There are numerous cover letter examples available online to help you get started. These examples can serve as a guide to format your cover letter and highlight your skills and experience. Use these examples to tailor your cover letter to your specific situation. However, remember to personalize your cover letter to make it unique and relevant to the job and company. Ensure it reflects your own personality and career aspirations. Adapt the examples to reflect your individual background and the specific requirements of the accounting clerk position you are applying for. You can find samples that suit different levels of experience and areas of specialization, such as accounts payable, accounts receivable, or general accounting.