Accounts Receivable Cover Letter Sample Essentials

A well-crafted accounts receivable cover letter is a critical first step in securing your desired position. It serves as your initial introduction to a potential employer, offering a concise snapshot of your skills, experience, and enthusiasm for the role. This document complements your resume by providing a narrative that underscores why you stand out as the ideal candidate. A strong cover letter has the power to significantly increase your chances of being invited for an interview, making it essential to invest time and effort in creating a compelling one. This guide provides insights and accounts receivable cover letter samples that will help you craft a powerful cover letter, thereby enhancing your prospects in the job market. Remember to tailor each cover letter to the specifics of the job description and the unique characteristics of the company. Avoid a generic approach; instead, personalize your letter to showcase your unique value proposition and maximize your chances of getting hired.

Formatting Your Cover Letter

The format of your accounts receivable cover letter is just as important as its content. A clean and professional layout conveys your attention to detail and organizational skills from the start. Adopt a standard business letter format, using a readable font like Times New Roman or Arial, in a 10-12 point size. Ensure consistent spacing throughout the document, and strive for a single-page length to maintain conciseness. The letter should be left-aligned, and avoid any distracting graphics or excessive formatting, which can detract from your professionalism. A well-formatted cover letter ensures easy readability, enabling the hiring manager to focus on the substance of your application. Conversely, poor formatting can detract from your professional image and might lead the employer to overlook your qualifications. By adhering to the right format, you can effectively present yourself as a focused and professional candidate who is ready to contribute to the team.

Contact Information

Begin your cover letter by including your contact information at the top. This should include your full name, complete address, phone number, and a professional email address. Make sure this information is clearly visible. This helps the employer contact you when there is interest. Always use a professional-sounding email address and avoid nicknames or informal addresses. Double-check the accuracy of your contact details to prevent any communication issues. This initial section sets a tone of professionalism and makes it easy for the hiring manager to contact you. This is the first step in showing how you value professionalism.

Date and Salutation

Following your contact information, include the date on which you are writing the letter. If possible, address the hiring manager by name. Research the hiring manager’s name and title, addressing them directly. If a specific name is unavailable, use a professional greeting such as “Dear Hiring Manager.” A personalized salutation demonstrates your initiative and attention to detail, indicating that you have taken the time to research the company and the role. Avoid generic greetings like “To Whom It May Concern.” It is a good way to show that you care about the details and increases your chances of being noticed by the hiring manager. It also signifies that you have invested time and effort in applying for the job, which is a sign of your commitment.

Body Paragraphs

The body of your cover letter is where you elaborate on your qualifications and express your sincere interest in the position. The standard format includes three to four paragraphs, each focused on a specific aspect of your suitability for the role. Clear and concise writing is essential, with each sentence contributing to the overall message. Use an active voice and strong verbs to convey confidence and clarity, making the information accessible and engaging. Aim to write paragraphs that are easy to read and understand, ensuring that the hiring manager can quickly grasp your key strengths and how they align with the job requirements. This is where you can provide insight into why you are the perfect fit.

First Paragraph Why You’re Applying

Start with a strong opening that immediately grabs the reader’s attention. State the specific position you are applying for and where you found the job posting. Briefly explain why you are interested in the company and the role, highlighting your enthusiasm and your basic understanding of the company’s mission or values. Demonstrate that you have done your homework, showing the hiring manager you’ve taken the initiative to learn about the company and the role. This initial paragraph is key to setting the stage, creating context for the remainder of your letter. It is vital to provide the hiring manager with a reason to keep reading. Use the introduction to present yourself as a proactive candidate, one who is eager to contribute to the company’s success from day one. This opening paragraph serves as your first impression, so make sure it is compelling.

Second Paragraph Highlight Skills and Experience

This is the ideal space to show your relevant skills and experience, showcasing the qualifications most pertinent to the job description. Provide specific examples of how you have successfully performed similar tasks in the past. Quantify your achievements whenever possible; for instance, “Reduced outstanding invoices by 15% within six months,” to provide concrete evidence of your capabilities. Mention your proficiency in essential accounting software, such as QuickBooks or SAP. Relate your abilities directly to the requirements of the role, demonstrating how your experience and skills make you a strong candidate. This paragraph is a chance to directly address the requirements specified in the job description, offering tangible proof of your competencies. It assures the hiring manager that you possess the skills necessary to excel in the position.

Third Paragraph Express Enthusiasm and Call to Action

In the final body paragraph, reaffirm your enthusiasm for both the specific role and the company as a whole. Express your eagerness to learn more about the opportunity and the specifics of the position. Include a confident call to action, such as “I am eager to discuss how my skills and experience can benefit your team and contribute to the company’s goals.” Thank the hiring manager for their time and consideration, leaving a positive impression, and reiterate your contact information to facilitate easy communication. This concluding paragraph is designed to leave a lasting positive impression and encourage the employer to take the next step, showing that you are motivated and ready to contribute. This will keep your application in the forefront.

Closing and Signature

Conclude your cover letter with a professional sign-off, such as “Sincerely” or “Best regards,” followed by your typed name. If submitting a physical copy, leave space for your handwritten signature above your typed name. Ensure your signature is clear and legible. This adds a personal touch and formalizes your application. A proper closing and signature complete the letter and leave a positive impression, showing your attention to detail and commitment to professionalism. This step is important to increase your chances of getting hired. Make sure that every detail is correct.

Key Skills to Showcase

Highlighting the right skills is crucial in your accounts receivable cover letter. The specific skills you emphasize should align with the job description, demonstrating your understanding of the role’s responsibilities and your ability to perform the tasks required. Including the key skills related to accounts receivable will help you show that you have the skills that they are looking for. Your cover letter should directly address the job requirements, making your application stand out. When you highlight the right skills, your application will stand out among many.

Accounting Software Proficiency

Mention your experience with accounting software such as QuickBooks, SAP, Oracle, or any other system used by the company. Provide specific examples of how you have used this software to perform key tasks, such as generating invoices, managing payments, or running detailed reports. Specify any certifications or training you have received in these software programs. Being proficient in relevant accounting software demonstrates your readiness to quickly integrate into the company’s workflow, showing you can readily perform necessary operations. Mentioning the specific software used by the company will show the employer that you have the knowledge and skills required and are ready to start immediately. This gives you a definite advantage over other candidates.

Attention to Detail and Accuracy

Emphasize your ability to maintain accuracy in financial records, which is a critical skill in accounts receivable. Mention your experience in verifying data, reconciling accounts, and diligently identifying any discrepancies. Provide examples of how you have ensured accuracy in the past, such as double-checking invoices or leveraging automated systems to reduce errors. Attention to detail is critical in accounts receivable, ensuring financial transactions are recorded accurately and that the company avoids potential financial issues. This will demonstrate how you do the job, providing tangible evidence that the employer needs. This skill is very valuable to any employer.

Communication and Interpersonal Skills

Highlight your communication and interpersonal skills, mentioning your ability to interact with clients, internal stakeholders, and vendors professionally and effectively. Provide specific examples of how you have successfully resolved disputes, negotiated payment plans, or communicated complex financial information to customers. Strong communication skills are essential in accounts receivable, as they help maintain positive customer relationships and ensure timely payments. This also shows that you can work well with others, including explaining technical information to those without accounting knowledge. This ensures that everyone is on the same page.

Problem-Solving Abilities

Showcase your problem-solving skills by mentioning your ability to identify and resolve payment discrepancies, investigate past-due accounts, and implement effective solutions to prevent future issues. Provide specific examples of how you have successfully solved problems and improved processes in previous roles. These abilities are highly valued in accounts receivable, as they empower you to quickly address and resolve complex issues, contributing to the efficiency and financial health of the company. This skill is also important because it ensures you have the tools and ability to overcome difficulties and provide solutions that benefit the employer.

Experience in Accounts Receivable

Demonstrate your relevant experience in accounts receivable by specifying the types of tasks you have performed. Be sure to include your experience with invoicing, collections, and reconciliation. Detail the number of years you have worked in accounts receivable, if possible. Providing specific examples of your experiences shows the employer that you can handle all of the responsibilities associated with the job, which is a significant selling point. This experience is vital to ensure that you are fully capable of performing the job effectively. This is another way you can make your application stand out.

Invoice Processing and Management

Describe your experience in invoice processing and management, emphasizing your ability to efficiently generate invoices, accurately track payments, and effectively manage accounts receivable aging reports. Specify the specific invoice processing software you have used in the past, and any process improvements you have implemented. Your expertise in invoice processing is a key area of expertise in accounts receivable, so be sure to highlight these experiences in your application. If you have the knowledge and skills, you should highlight them in your cover letter. Invoicing is a core duty of an accounts receivable specialist, so demonstrating your skills in this area makes you a more attractive candidate.

Collections and Payment Reconciliation

Highlight your experience in collections and payment reconciliation. Mention your experience in contacting clients regarding past-due invoices, negotiating payment plans, and successfully reconciling payments with outstanding balances. Provide specific examples of how you have improved collection rates or reduced outstanding debt, illustrating your impact. Experience in these areas demonstrates your ability to effectively manage the financial health of the company and shows that you can be successful in getting payments. This skill is one of the core responsibilities of the job. Showing that you have this experience makes you an extremely desirable candidate.

Credit Risk Assessment

If applicable, describe your experience in credit risk assessment, mentioning your ability to evaluate the creditworthiness of clients, set appropriate credit limits, and expertly manage credit policies. Detail any credit risk management strategies you have successfully implemented in previous roles. This skill is highly valuable in accounts receivable, as it allows you to minimize financial risk and promote the stability of the company. Demonstrating your ability to handle more than just processing invoices increases your value to a potential employer.

Customizing Your Cover Letter

Customizing your cover letter is essential for making a strong impression. Tailor your letter to each specific job application, and avoid using a generic template that doesn’t align with the role and the company. This demonstrates your interest in the specific role and the company, as well as showcasing your commitment to the details. Personalize the letter to address the company, the specific role, and the unique requirements mentioned in the job description. This will make your application stand out from others. Customization enhances the relevance of your application, making it clear how your skills and experience align directly with the job requirements, which is what employers are looking for. Tailoring is a great way to grab their attention.

Tailoring to the Job Description

Carefully review the job description and pinpoint the most important requirements and skills sought by the employer. Highlight the skills and experiences that align directly with these requirements. Use the keywords and phrases directly from the job description to effectively showcase your relevance to the position. Tailor your cover letter to specifically address the needs and requirements of the employer, demonstrating that you have fully understood the role and are a great fit for the company. This will also help the hiring manager quickly see if you are qualified to take the next step in the hiring process. This is a great way to move your application to the top.

Highlighting Relevant Accomplishments

Instead of merely listing your duties, use accomplishments to demonstrate your value and impact in previous roles. Quantify your achievements whenever possible, such as, “Reduced outstanding invoices by 10% within three months,” to provide concrete evidence of your capabilities. Use the STAR method (Situation, Task, Action, Result) to structure your examples and effectively showcase your successes. This will also show what you have accomplished at previous jobs. Highlighting your accomplishments demonstrates your ability to achieve tangible results and provides solid evidence of your skills. Use quantifiable data to show that you have done the job and are able to have future success. These facts can greatly increase your chances of being hired.

Proofreading and Editing

Proofreading and editing your cover letter is absolutely essential for ensuring that your application is polished, professional, and free of errors. Errors, no matter how small, can undermine your credibility and severely damage your chances of getting an interview. Always use a grammar and spell checker to identify and correct any mistakes. After that, read your letter carefully, paying close attention to every detail. Consider asking a friend or colleague to review your cover letter, as a fresh pair of eyes can often catch errors that you might have missed. Proofreading and editing ensure that your cover letter is polished and professional, demonstrating your attention to detail. This shows a potential employer that you are serious. Proofreading will increase your chances of getting hired.

Ensuring Accuracy and Professionalism

Double-check all information included in your cover letter, paying particular attention to the company name, job title, and all contact details. Ensure that your language is consistently professional, and maintain an appropriate tone throughout the document. Avoid using slang, jargon, or overly casual language. Be positive, enthusiastic, and demonstrate your genuine interest in the role, showcasing your commitment and making a positive impression on the reader. Accuracy and professionalism are essential for making a positive impression on the reader. They demonstrate that you are a serious candidate who is committed to the details of the job. This will increase your chances of getting hired.

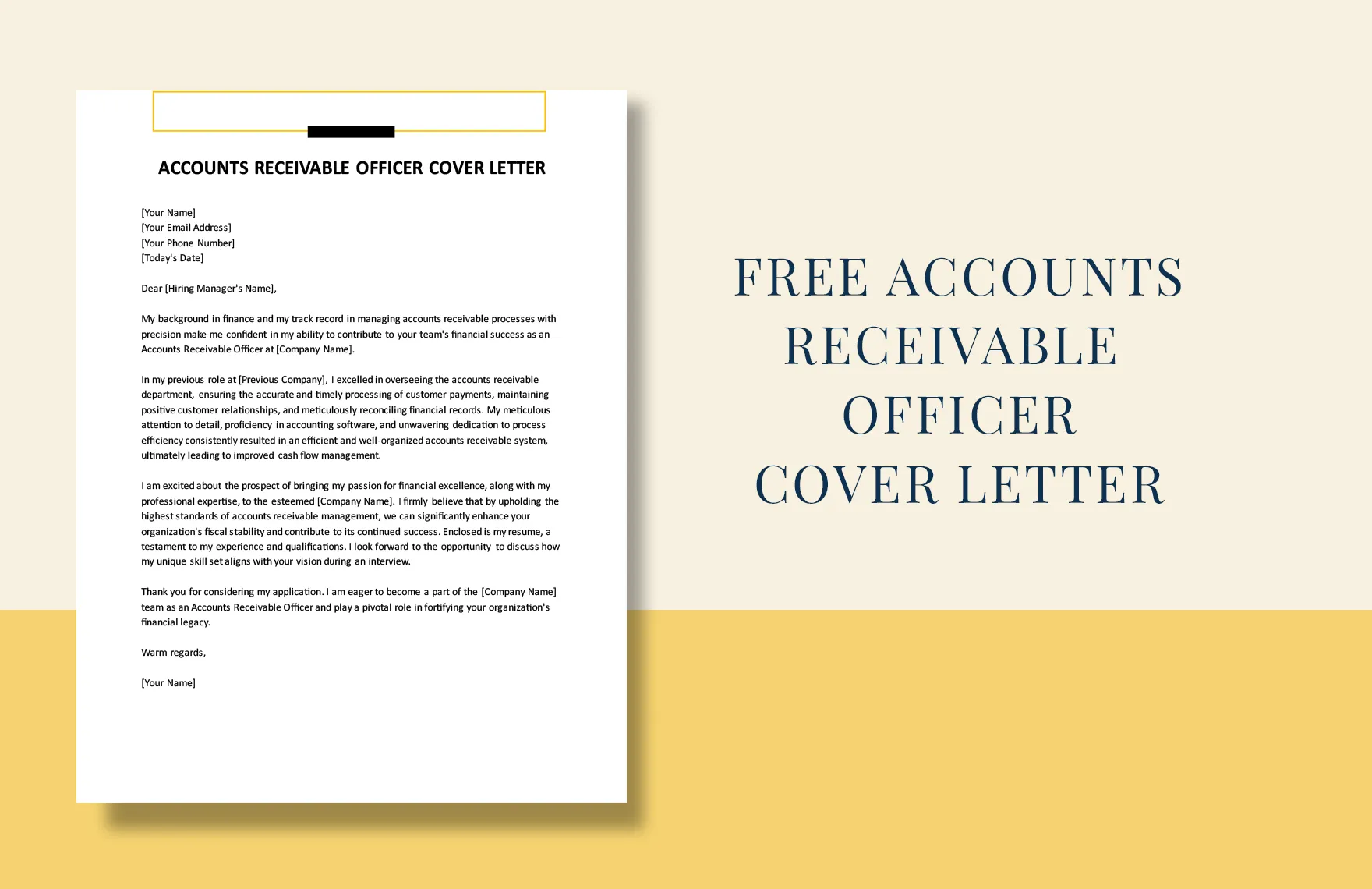

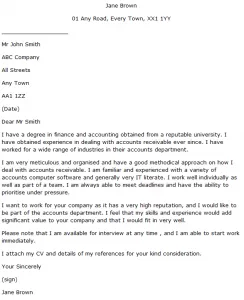

Accounts Receivable Cover Letter Sample Examples

Below are sample accounts receivable cover letters designed to help you create your own personalized cover letters. [Insert examples here - consider different scenarios, such as a cover letter for an entry-level position, one for someone with experience, and one for a specific type of industry]. These examples can serve as a solid starting point for your own application, but it is very important to personalize them, tailoring them to reflect your unique qualifications and the specific job you are applying for. Remember to tailor each cover letter to the job description and company’s requirements, showing that you did your homework. These samples will provide a great template so that you can then create your own successful accounts receivable cover letter.